Operating cash flow plus the cash flow to creditors plus the cash flow to shareholders. The more free cash flow a.

How To Calculate Net Cash Flow Gocardless

This article by score has a template for a 12 month cash flow statement.;

Cash flow from assets is defined as quizlet. The cash that a firm generates from its normal business activities. Cash flows from operating activities. A firm's net profit over a specified period of time.

All of these are considered to have a positive effect on cash. E) cash flow to creditors. D) cash flow from assets.

If the total unpaid purchases are greater than the total sales due, you'll need to spend more cash than you receive in the next. In accounting practice, operating cash flow is often defined as net income plus depreciation. Here we provide you with the cash flow from assets formula.

P revious edition 7) in the statement of cash flows, cash flows from operating activities are cash flows directly related to purchase and sale of fixed assets. A) the total amount of interest and dividends paid during the past year. [because supplies is a current asset, the increase in cash will appear in.

A quick and easy way to perform a cash flow analysis is to compare your total unpaid purchases to the total sales due at the end of each month. The cash flow from assets can be defined as the. Cash flow from operations 21,500 cash flow from investments:

Cash flow to shareholders minus the cash flow to creditors. B) capital spending cash flow. Operating cash flow is an important benchmark to determine the financial success of a company's core business activities.

Operating cash flows arise from the normal operations of producing income, such as cash receipts from revenue and cash disbursements to pay for expenses. Operating cash flow is defined as: Cash flows from operating activities result from providing services and producing and delivering goods.

31) the cash flow related to interest payments less any net new borrowing is called the: 32) cash flow to stockholders is defined as: Interest is deducted when net income is computed.

S tatement of cash flows question status: Four easy ways to get a cash flow statement. Cash flow (1) noun:the cash available from an investment after receipt of all revenues and after payment of all bills.(2) verb:the process of creating cash flow,as in “i think that property will start to cash flow in about a year.”a property can have positive cash flow (good) or negative cash flow (usually bad).cash flow is not the same thing as profitability.a property can be profitable.

So, the cash flow from assets was: Cash flow from assets can be defined as: The change in the net working capital over a stated period of time.

Operating cash flow minus the change in net working capital minus net capital spending. They include all other transactions not defined as noncapital financing, capital and related financing or investing activities. Free cash flow (fcf) is the money a company has left over after paying its operating expenses and capital expenditures.

Financing cash flows arise from a company raising funds through debt or equity and repaying debt. Supplies (on hand) is a current asset account.a decrease in any asset account balance (other than cash) is assumed to be a source of cash, provided cash, increased cash, or have used less cash than the amount of supplies expense shown on the income statement. The net amount of a firm’s cash flows that are spent on fixed assets is called:

Cash available to distribute to the creditors and to the stockholders. In accounting, cash flow is a measure of changes in a company's cash account, specifically its cash income minus the cash payments it makes. The cash that is generated and added to retained earnings.

Free cash flow is another term for the: Cash flow from assets = cash flow to creditors + cash flow to stockholders. This problem has been solved!

Chapter 13 Capital Budgeting Estimating Cash Flows And Analyzing Risk Intermediate Financial Management Flashcards Quizlet

How Do Net Income And Operating Cash Flow Differ

Gs - Acct 2302 Ch 14 The Statement Of Cash Flows Flashcards Quizlet

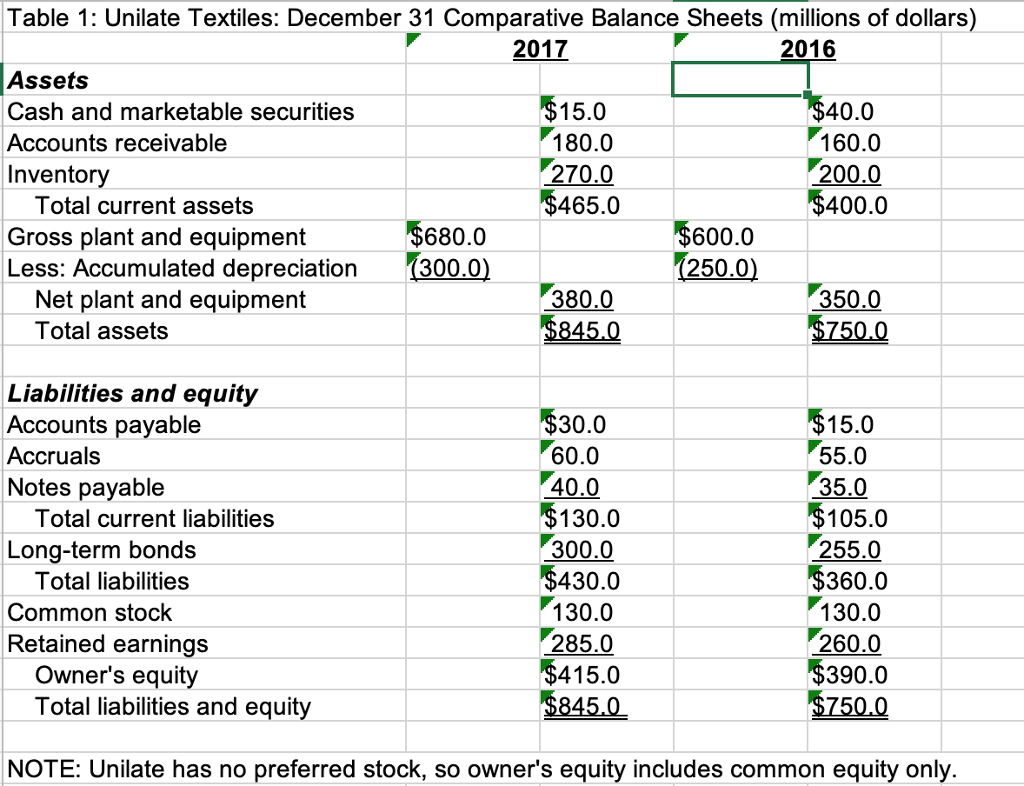

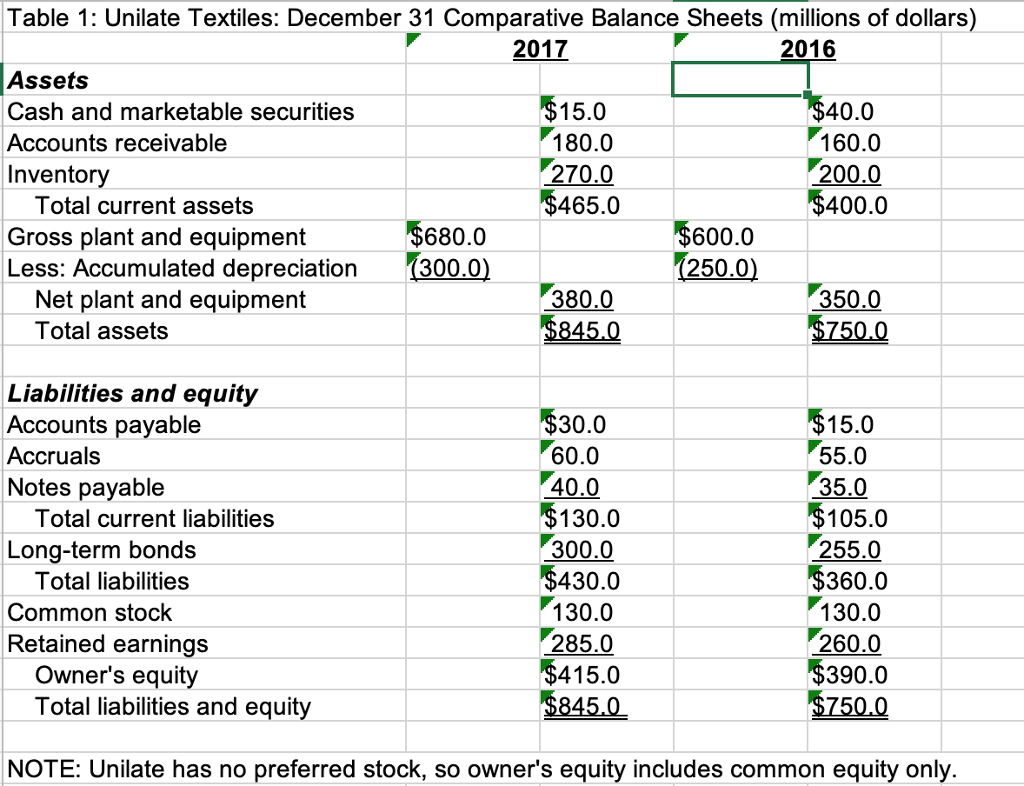

The Balance Sheet Boundless Finance

How Do Net Income And Operating Cash Flow Differ

Gs - Acct 2302 Ch 14 The Statement Of Cash Flows Flashcards Quizlet

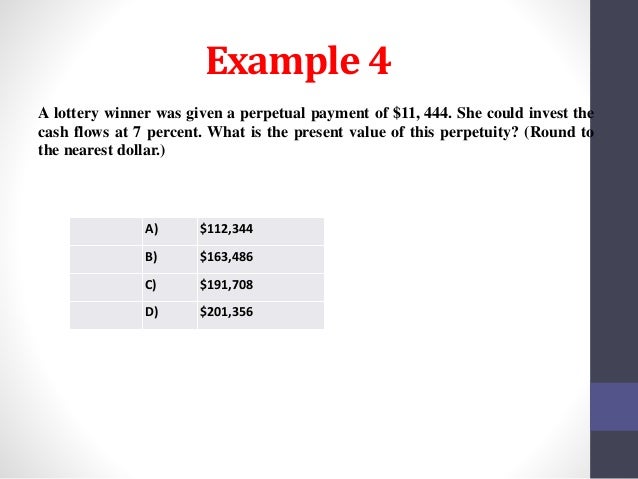

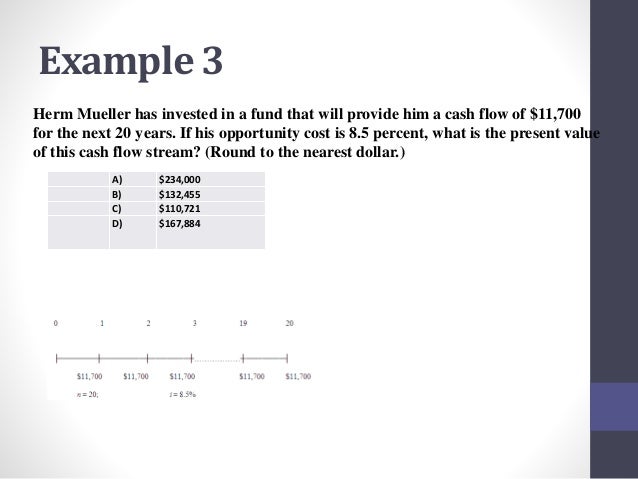

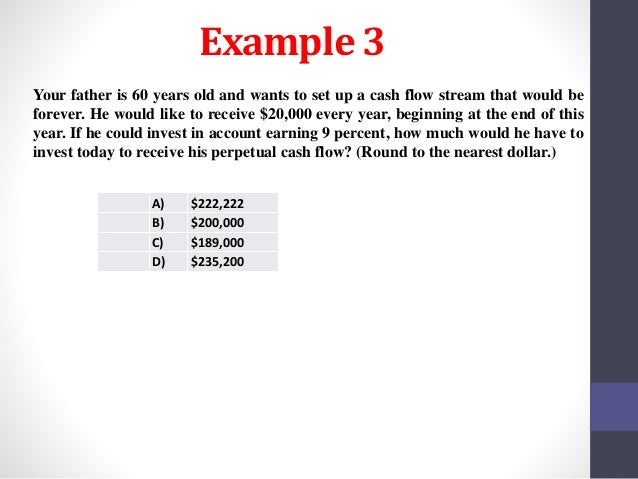

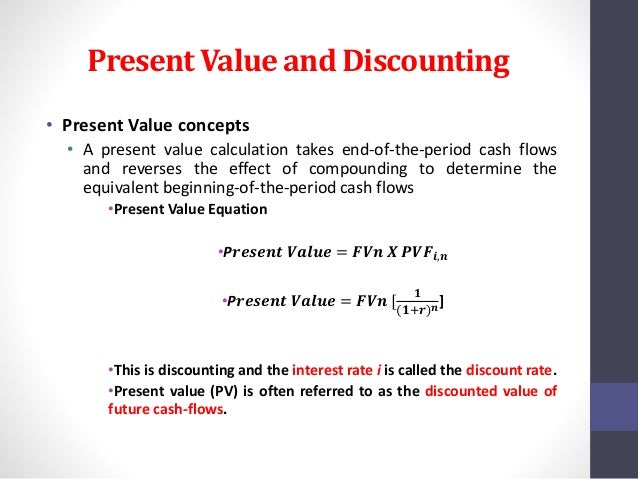

Chapter 6 The Time Value Of Money

Finance Test 1 Flashcards Quizlet

Cash Flow To Stockholders Is Defined As - Bloglifcoid

Reading 25 Understanding Cash Flow Statements Flashcards Quizlet

Chapter 6 The Time Value Of Money

241 Test 1 Flashcards Quizlet

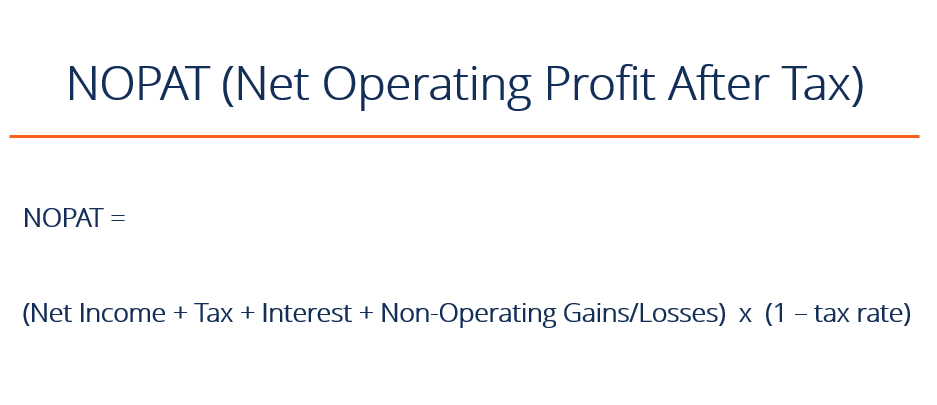

Nopat Net Operating Profit After Tax - What You Need To Know

Chapter 6 The Time Value Of Money

Reading 25 Understanding Cash Flow Statements Flashcards Quizlet

Chp 2 - Financial Statements Cash Flow And Taxes Flashcards Quizlet

How Do Net Income And Operating Cash Flow Differ

Engineering Econ 2 Flashcards Quizlet

Chapter 6 The Time Value Of Money