This means that profits earned in the corporation will not be taxed at the corporate level, but instead will be deemed to flow through to the shareholders and be taxable as personal income, even if a shareholder has not actually received those. In addition, the recent changes that

Doing Business In Canada Originally Presented At Alliott North American Conference On January 11 2012 Updated January 28 2013 Presented By Aaron - Ppt Download

Flow through entity means an entity that for the applicable tax year is treated as an s corporation under section 1362(a) of the internal revenue code, a general partnership, a limited partnership, a limited liability partnership, or a limited liability company, that for the applicable tax year is not taxed as a corporation for federal income tax purposes.

Flow through entity canada. The information in this section also applies if, for the 1994 tax year, you filed form. A related segregated fund trust; Tax treaty (the “treaty”) because, in the view of the cra, it does not qualify as a.

And (2) by reason of Looking back, mining executives, lawyers, bankers and accountants believe this quirky canadian tax innovation has generated billions for mining exploration and contributed to the development of some of the country’s most notable mines, such as the ekati and diavik diamond properties. Flow through entities owned by residents of canada in the united states certain business entities such as limited liability companies (llc) or subchapter s corporations are “flow through” entities, where the entity does not pay tax, but where the net income and other tax results flow through to the members or shareholders on a pro rata basis.

Canadian resource companies are permitted to fully deduct specific In some situations, a u.s. A ulc may be treated in the united states as the equivalent of a.

The cra does not accept that a u.s. A trust governed by an employees' profit sharing plan Only the provinces of alberta, british columbia, and nova scotia permit the creation of an unlimited liability company (ulc).

Cross-border Financing And Investment Structures - Pdf Free Download

The Rise And Fall Of Canadian Income Trusts - Tax - Canada

Viewpoints - Prospectors Developers Association Of Canada Pages 1 - 4 - Flip Pdf Download Fliphtml5

Tridenttrustcom

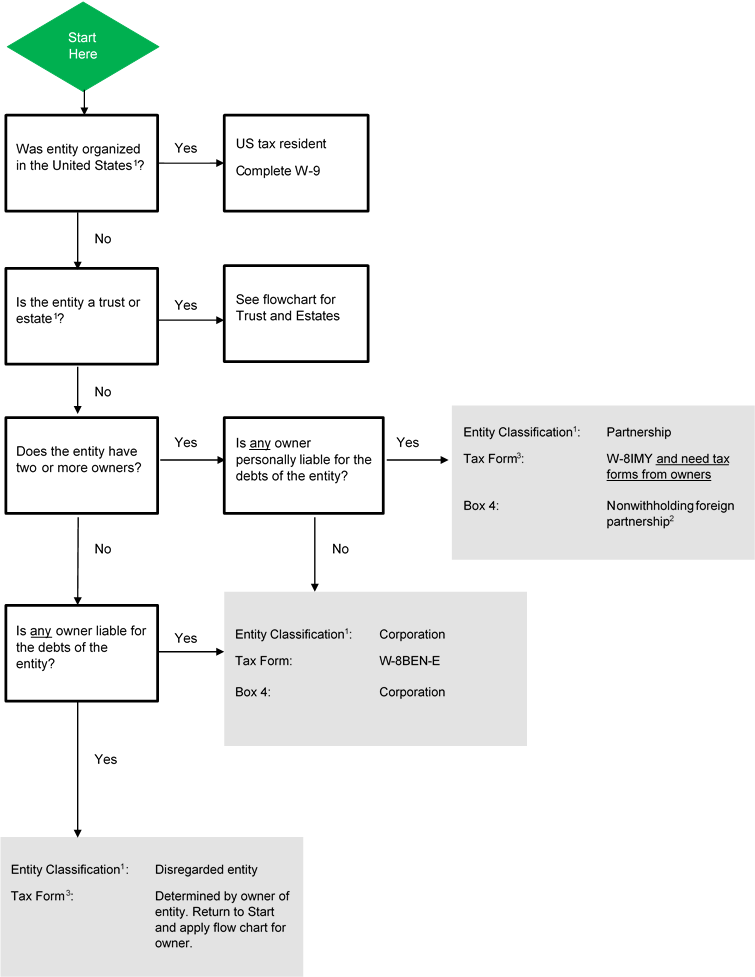

Entity And Fatca Classification For Non-financial Entities Ib Knowledge Base

Ninepoint 2021 Flow-through Lp Ninepoint Partners Lp

The Benefits Of Using An Unlimited Liability Company - Pdf Free Download

Tsg - Tax Specialist Group

From Principles To Planning International Tax Treaties - Canada From Principles To Planning - Ppt Download

Flow-through Shares Mining Tax Canada

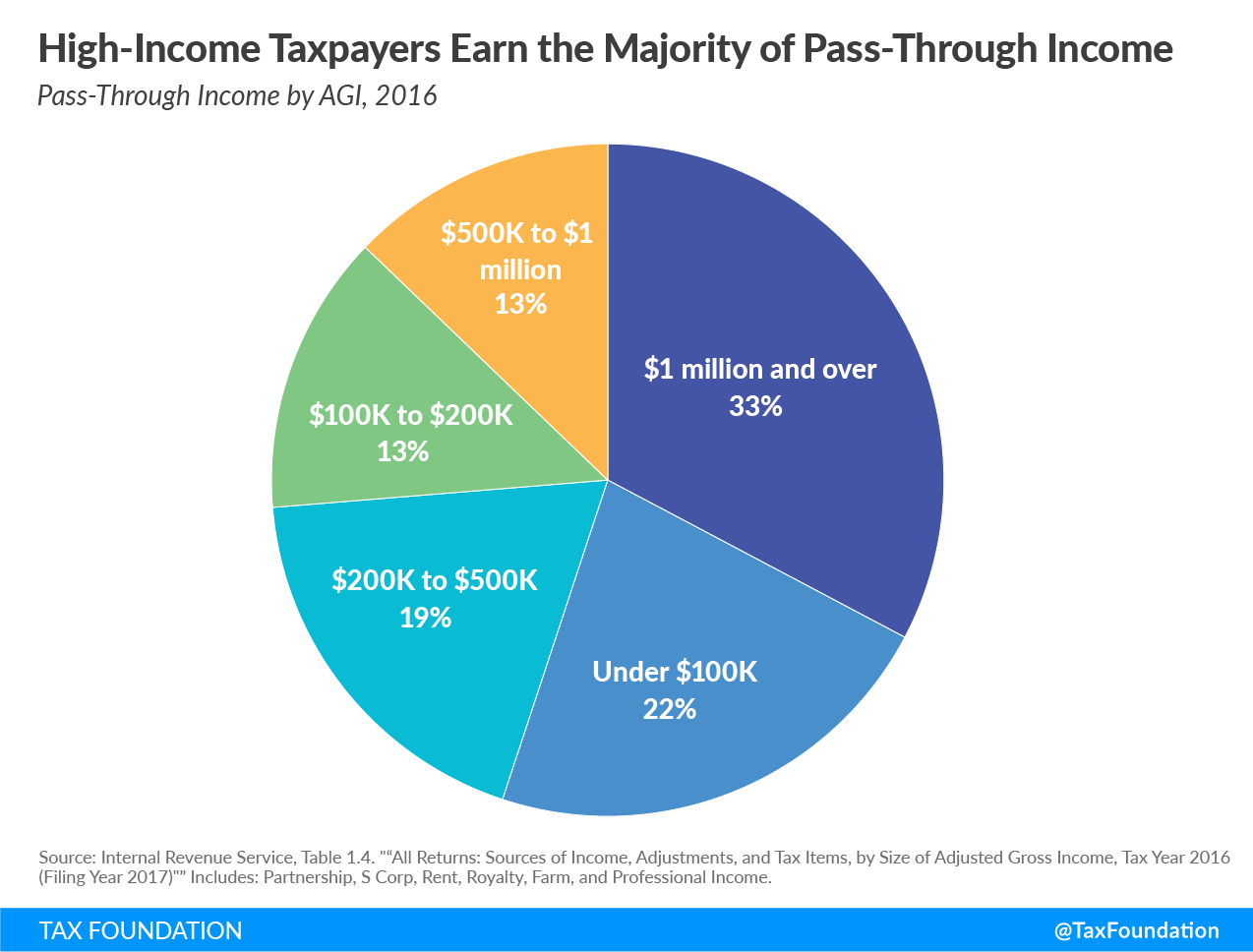

What Is A Pass-through Business How Is It Taxed Tax Foundation

Canadian Outbound Taxation - International Tax Blog

Acccom

What Are Pass-through Businesses Tax Policy Center

What Are Pass-through Businesses Tax Policy Center

Flow-through Shares An Overview For Mining Executives Pwc Canada

Flow-through Shares Mining Tax Canada

Iaspluscom

Double Taxation Of Corporate Income In The United States And The Oecd